Sunday, December 31, 2006

A Land Of Opportunity

In the US, I will do the following five things;

(1) I will think and talk more positively about politics.

In Japan I have thought and talked about politics. However, I couldn't be inspired by discussing politics at an intellectual place. At the graduate school which I went to, there were many students who I thought had a lot of knowledge of social science, but it seemed they usually avoided discussing politics with other students. It was likely politer for them not to bring political matters into their discussion. In some cases, it may be politer for them to do that, but in other cases, it may not be. I think an intellectual place like a university should be the free place for political and social discussions.

(2) I will broaden my perspectives on the activities in an international society.

In the US, I'll have many chances to see what I've never seen before. In some cases, I may have to know more what I've never known. In other cases, I may find I've ever done wrong things. My value judge would be changed in an inter-cultural circumstance. I hope I will change myself among many other international students to remain the same myself.

(3) I will devote myself to the researches of economic theory.

I've studied economics for about 5 years at my undergraduate and graduate school. For those years I may have taken a roundabout way to the pursuit of economics: In fact I stopped studying economics and worked for a company at one time. I gave up seeking a career of economist which I had hoped to be because I thought it very difficult to become an economist. Certainly it is very hard to make a living as an economist in any countries other than Japan and the US. But, during my several months of work experience, I came to think the possibility of becoming an economist depends on how firm my will is. I found I had to try as hard as possible.

(4) I try to know more about the US as well as Japan.

When I am in the US, it is waste of time for me not to try to know more about the way of life in the US. I want to know about the life and politics of the US if I can live in the US. This is very valuable chance that I think I will never get again in my whole life. By knowing about the US, I feel I can know more about my home country, Japan. My desire to know more about the US is no less than that to know more about the Japan.

(5) I will make friends who do a research activity with me.

In Japan I couldn't make friends who pursue a research activity with me. Certainly it was because of me: I couldn't find the friends with the same interests as me. Again I try to find the friends who have the same interests and want to learn more from them. I think I always need an open-mined sense and have to have more chances to talk to many other graduate students.

Soon the sun appears and a new year comes to us. I hope a new year will take me to the US, where I will change myself.

Statement of Objectives

Taro Okamoto

The PhD program in Economics, the Department of Economics

December 2006

This statement has four sections. The first section briefly describes my intellectual background and interests. The second section gives the reasons for applying to the Department of Economics at (Withheld), and the third section elaborates on my proposed research topics. Finally I state what I expect as my future career.

1. My Intellectual Background and Interests

While pursuing undergraduate study in economics at (Withheld) I was fascinated by two lectures: Macroeconomics and American economy.

They both had a lot of interesting topics. The lecture in Macroeconomics illuminated very realistic issues: what caused the recession and deflation in the 1990s in Japan and what expansionary fiscal policy and ultraloose monetary policy did.

And the lecture on the American economy exposed me to many interesting economists and their thoughts such as Paul R. Krugman and John K. Galbraith. I read their books with much excitement. Then the U.S. economy was booming due to the advance of information technology, whereas the Japanese economy was in prolonged recession. This contrast intrigued me and heightened my interests in the study of macroeconomics and macroeconomic policy. I wrote an essay on the booming American economy, which won the prize in the Student Essay Contest at the Department of Economics. This experience made me believe that economics helps clear up our ideas about the economy in which we live.

So I decided to pursue further study in economics and read N. Gregory Mankiw’s best-selling textbook Macroeconomics, which was easy to read and had a lot of case studies about macroeconomics as well as data on the American economy.

After obtaining a BA degree from (Withheld), I entered the Graduate School of Economics at (Withheld). There I wanted to acquire basic knowledge of quantitative analysis since I did not take any such courses when I was in (Withheld). So I took the core graduate-level courses on econometrics and statistics. I also took the course on international finance and became interested in various issues in this area.

In this course, I read some intriguing empirical articles and began to reflect on the exchange rate policy. This lecture was a key to my decision to do a master's thesis in this area. In this regard I was also lucky to have had an opportunity to take part in the relevant research project as a summer internship for two weeks at (Withheld), one of the most prominent private consulting firms in Japan.

There I helped research the economic relationship between China and Kansai region which is the west area of the Japanese Islands, and could see the actual business interaction between China and Japan. I found that the economic activities of China influence heavily those of Japan.

After receiving an MA degree in applied economics and policy from the Graduate School of Economics at (Withheld), I worked at a private company for a while. However, my desire to study economics was getting stronger day by day and so was my interest in research of the Asia-Pacific economy.

2. Proposed Research Topics

The experience of taking part in a research project on Japan's economic interaction with China at (Withheld) heightened my interest in the study of economic activities in the East-Asia region.

Japan is now highly integrated with China, ROK and many other countries in the East-Asia region. These countries have become interested in accelerating regional integration through, say, an economic partnership agreement (EPA). In addition, there has been a lively debate as to whether a common currency should be adopted.

Empirical work in this regard has been focused on the question of whether the East-Asia region constitutes an optimum currency area (OCA): Alesina, Barro and Tenreyro (2002), for example, shows empirically that there exists no clear yen area, based on the historical data on inflation, trade and co-movements of prices and outputs. Looking around the world, we can see many examples of movements toward multinational currencies: 12 countries in Europe have adopted a single currency (Euro), and 6 oil-producing countries such as Saudi Arabia, Oman and so on, have declared their intention to form a currency union by 2010.

International economic integration has advanced since Mundell (1961) first developed the concept of OCA. In today’s globalized world, it is natural for policy makers to think of adopting a common currency. In theory the exchange rate uncertainty is a serious impediment to international trade. Adoption of a common currency does away with this source of uncertainty and hence reduces the transactions costs associated with trading goods, services and assets. The resulting boost to trade integration may also promote co-movements in income, that is, business cycle symmetry.

Some economists suggest a theoretical possibility that if most trade is inter-industry, then trade integration results in greater specialization and thus asymmetric business cycles. In this case, adopting a common currency, and hence a common monetary policy, is not beneficial for the participating countries. Frankel and Rose (1998), however, found a strong positive relationship between trade integration and synchronization of business cycles, suggesting that most trade is intra-industry rather than inter-industry.

To judge an OCA, economists generally examine four linkages between countries: (1) the extent of trade integration, (2) similarity of the shocks and cycles, (3) the degree of labor mobility, and (4) the system of risk-sharing, through fiscal transfers. The greater any of the four linkages between the countries, the more suitable they are to adopt a common currency. In a way similar to Lucas Critique (1976), Frankel and Rose suggests that the traditional judgments on the fitness for OCA do not adequately take into account the impact of adopting a common currency on trade integration. Frankel and Rose thus argues that some of the criteria to determine OCA are endogenous.

In my master's thesis at (Withheld), I summarized the relevant issues on OCA from a somewhat different point of view from Frankel and Rose: Based on the research of Kawai (1993), I used a framework of game theory and tried to consider theoretically how the choice of exchange rate regimes is optimally made by each country’s monetary policymaker who pursues national objectives like low inflation and high economic growth. Specifically, I examined how the monetary policy conducted by each country affects the choice of regimes and thus the formation of currency union. The ability of each monetary authority to make a policy commitment (e.g. not to inflate or to fix the exchange rate) is essential for the nature of the regimes chosen: If all the policy makers of the participating countries can make a fully credible commitment, currency union would be both Pareto-optimal and sustainable.

As the next step I would like to pursue this line of research first by extending a literature search in this area. I then build a theoretical model, derive propositions from the model and conduct an empirical research by using econometric methods. It would be interesting to see how the conflicting interests between the participating countries affect the path towards the formation of currency union. Through the studies on the OCA and their application to the East-Asia and Pacific region, I would like to carry out a research on policy issues regarding the inter-connections between international integration, currency system and the economic structures in the countries in this region.

Looking further into the future, I hope to widen the scope of my research effort to other issues, such as the impact on domestic and neighboring economies of increased international labor mobility and of economic structural change and reform.

4. My Career Goals

After my PhD, I would like to be a researcher and a teacher specialized in international finance with particular interests in the Asia-Pacific area. I hope to be able to contribute to a sound development of the Asian-Pacific economy in general and its financial system in particular through a policy-analytic research, sometimes in collaboration with international financial institutions as well as the governmental and private think-tanks.

In addition, by speaking at seminars and writing articles for non-academic journals I would like to heighten the public awareness of the problems in international economy lying ahead of us, thereby facilitating the adoption of a sound policy to deal with them.

Reference

1 Alberto Alesina, Robert J. Barro, Silvana Tenreyro (2002), “Optimal Currency Areas”, NBER Working Paper 9072, National Bureau of Economic Research. http://www.nber.org/papers/w9072

2 Jeffrey A. Frankel and Andrew K. Rose (1998), “The Endogeneity of the Optimum Currency Area Criteria”, The Economic Journal, 1009-1025.

3 Masahiro Kawai (1993), “Optimal and Sustainable Exchange Rate Regimes: A Two-Country Game-Theoretic Approach”, IMF staff papers, 329-368.

4 Richard E. Caves, Jeffrey A. Frankel, Ronald W. Jones (2003), “World Trade and Payments: An Introduction”, Addison Wesley.

5 Robert Mundell (1961), “A Theory of Optimum Currency Areas”, American Economic Review, vol.51, 509-517.

6 Robert E. Lucas (1976), “Econometric Policy Evaluation: A Critique”, Carnegie-Rochester Conference Series on Public Policy, Amsterdam: North-Holland, 19-46.

Thursday, December 28, 2006

I Confess You

(1) The University of Hawaii at Manoa

(2) The University of South Carolina, Moore School of Business

(3) Binghamton University, State University of New York

(4) The University of Wisconsin-Milwaukee etc.

I' ve applied to the PhD program in economics and there wanted to pursue the study of international finance. (I will talk to you about my proposed research later.) Now my application process is going on.

I wonder if I should tell you the name of the university I applied to, but I think there is no serious problem in exposing it to you.

I think the above four universities are good at the research in the field of international economics. Their courses are small, interactive and intensive ones, and one of them has an interdisciplinary one. My graduate teacher said to me, "Good choice, Taro". I think so, too.

My God, please have them accept me!

If one of them accepts me, I will start a US graduate student's blog here.

Much of the topics on not only international society, but also on my private graduate life will be released obviously. I hope I will provide the students who think about starting the application process to the graduate school with helpful information.

A Next Economist

Since I was an undergraduate student, I have wanted to go to the graduate school in the US and to study advanced economics in the classroom at US graduate school. And I want to be an economist at university or college. This is my big resolution. I am going to devote my life to the research on economics.

Now I hope I will take a ticket to the way to the econ graduate school in the US.

Everyone, have a happy new year! And thank you for having kept an eye on my blog! Next year I will try to write more on this blog. Please go and see my blog!

Friday, December 08, 2006

Never Pearl Harbor

At school I learned the war on the U.S. had begun since the attack. Then Japan took the road to hell. Japanese soldiers dreamed a victory over the U.S., but in fact it was a tragedy that came true to them.

Isoroku Yamamoto, a Commander-in-Chief of the Imperial Japanese Navy (IJN) during the first four years of World War II, and ex-student at Harvard, commanded the attack. However, he is said to have been against the attack on the U.S. He knew the military power of the U.S., and didn't think Japan would win the U.S.

That event at Pearl Harbor reminds me of fruitlessness of war. That is the tragedy not only for the U.S. people, but also the Japanese citizens. I do not want either to justify or criticize the sudden and cruel attack on the Pearl Harbor. I just want to keep in mind that event.

Thursday, December 7, 2006

The Washington Post

The attack killed more than 2,400 Americans, including 1,177 on the USS Arizona battleship; sank or damaged 21 ships; and destroyed 188 aircraft. The next day, Dec. 8, 1941, President Franklin D. Roosevelt asked Congress to declare war on Japan. The United States had entered World War II. At Pearl Harbor, a Solemn Remembrance500 WWII Veterans Mark 65th Anniversary in Gathering That Could Be Last for ManyAssociated PressFriday, December 8, 2006.

.....PEARL HARBOR, Hawaii, Dec. 7 -- One by one, survivors from ships sunk 65 years ago Thursday in the Japanese attack on Pearl Harbor laid wreaths under life-preserver rings honoring their ships. Nearly 500 survivors bowed their heads at 7:55 a.m., the minute planes began bombing the harbor in a surprise attack that thrust the United States into World War II.

..... "America in an instant became the land of the indivisible," said former NBC Nightly News anchor Tom Brokaw, the author of "The Greatest Generation," who spoke at the shoreside ceremony. "There are so many lessons from that time for our time, none greater than the idea of one nation greater than the sum of its parts."

Many were treating the gathering as their last, uncertain whether they would be alive or healthy enough to travel to Hawaii for the next big memorial ceremony, the 70th anniversary.

"It is because of you and people like you that we have the freedoms we enjoy today," Capt. Taylor Skardon said after relating each ship's story at the end of the ceremony.

A priest gave a Hawaiian blessing and Marines performed a rifle salute. For many World War II veterans, the visit to the attack site could be their last. "Sixty-five years later, there's not too many of us left," said Don Stratton, a seaman 1st class who was aboard the USS Arizona on Dec. 7, 1941. "In another five years I'll be 89. The good Lord willing, I might be able to make it. If so, I'll probably be here. I might not even be around. Who knows? Only the good Lord knows." Stratton and other survivors were boarding a boat to the white memorial straddling the sunken hull of the Arizona, where they were going to lay wreaths in honor of the dead.

"We thank those who lost their lives 65 years ago, and we honor the survivors and their families who are with us here today," said Hawaii Gov. Linda Lingle. The Arizona sank in less than nine minutes after a 1,760-pound armor-piercing bomb struck the battleship's deck and hit its ammunition magazine, igniting flames that engulfed it. More people were killed on the Arizona that day than on any other ship. In all, 1,177 servicemen perished, or about 80 percent of the crew. Altogether, the attack killed 2,390 Americans and injured 1,178.

Twelve ships sank and nine vessels were heavily damaged. More than 320 U.S. aircraft were destroyed or heavily damaged by the time the invading planes were done sweeping over military bases from Wheeler Field to Kaneohe Naval Air Station.

......Japanese veterans who participated in the attack as navigators and pilots will also pay their respects, offering flowers at the Arizona memorial for the American and Japanese who died.

Japan lost 185 men, mostly on dive-bombers, fighters and midget submarines. Some Japanese veterans and American survivors have reconciled in the decades since. Japanese dive bomber pilot Zenji Abe has apologized to American survivors for the sudden attack, ashamed his government failed to deliver a declaration of war in time for the assault.

The Japanese aviators who carried out the attack thought the declaration had already been made by the time they started bombing, Abe has said.

That attack is not a fact but history to me. Certainly to the U.S. veterans survived from it, it is an unforgettable fact. However, to many young people like me it is mere one page of large history book.

History doesn't always tell the truth. History might tell us no tragic story of Pearl Harbor, in some day. Hence the Pearl Harbor should continue to be told and be remembered. It is because that tragedy gives us the reasons why we mustn't go to futile war. I hope no war will there be in the future.

Monday, December 04, 2006

Japan-U.S. Security Treaty Useful?

There has been a controversy on whether Japan should keep the security treaty with the U.S. As a high school student, I was taught that Japan-U.S. Treaty was a kind of military alliance and very dangerous to our social life.

As teachers said, Japan should throw away the Treaty because it is against the Constitution of Japan which prohibits Japan from being involved to any military actions. That's an extreme response, I think. However, it may be also an extreme that the Japan-U.S. Security Treaty saves our nation.

Is it useful? It certainly prevents the enhancement of nuclear power and contributes to the stability of the Asia-Pacific region, I guess. The following survey says:

The Yomiuri Shimbun

Dec. 2, 2006

The response was the strongest support for the treaty since the survey was switched to a telephone survey in 2000, and was up four percentage points from last year.

Specifically, people were asked "To what extent do you think the Japan-U.S. Security Treaty contributes to the security of the Asia-Pacific region?" Positive answers were divided into two responses: "Contributes greatly" and "Contributes somewhat."

Eighteen percent of respondents, down three percentage points from 2005, said the treaty was not instrumental, answering that it either "does not contribute very much" or "does not contribute at all." It was the first time that unfavorable views to the treaty were less than a combined 20 percent.

The Japanese side of the survey was conducted Nov. 17-20 with 5,000 households selected randomly to answer questions by telephone. Of the 5,000 households, 1,823 had eligible voters and 1,002 of them, or about 55 percent, gave valid answers.

On the troop strength of U.S. forces stationed in Japan, 46 percent of the respondents, up eight percentage points from 2005, said the current level should be maintained. The figure was also a record high for the survey. Thirty-five percent said the number "should be reduced," down 8 percentage points from last year.

It was the first time since the 2001 survey that "maintain the status quo" answer on regarding U.S. troop levels surpassed "should be reduced."

The record high figures are probably due to feelings that North Korea's test launch of missiles and its nuclear test pose a serious threat to Japan's security, analysts said.

To the question "If Japan were attacked by another nation, do you think the United States would or would not help Japan militarily?," 71 percent answered, "Yes, [the United States] will help," down five percentage points from the 2001 survey. Eighteen percent chose "No, [the United States] will not help."

"If Japan were to be attacked by another nation, do you think the United States would or would not help Japan militarily?"

To such the question, 71 percent answered, "Yes". Very interesting point.

Would the U.S. really save Japan? My reply is somewhat negative: The U.S. would tell us Japan to save itself by itself. Would the U.S. would retaliate against the aggressor for Japan? Does it benefit the U.S.? I don't think so. The U.S. would do just only what benefits itself, as well as any nations.

Value Diplomacy

The Yomiuri Shimbun

Dec. 2, 2006

.....The envisaged policy is aimed at clarifying Japan's global contribution and serving national interests, such as securing natural resources, through active assistance in these regions.

Aso said Thursday the new vision will become a pillar of diplomatic strategies of the administration of Prime Minister Shinzo Abe. "Another new core policy will be added to the basis of Japan's diplomacy, strengthening the Japan-U.S. alliance and enhancing relations with neighboring countries, including China, South Korea and Russia," Aso said at a lecture organized by the Japan Institute of International Affairs at a Tokyo hotel.

Aso said the government would:

-- Employ "value diplomacy" that emphasizes "universal values" such as democracy, freedom, human rights, rule of law and a market economy.

-- Be actively involved in establishing the arc of freedom and prosperity, which will connect a band of emerging democracies around the Eurasian continent.

Japan's assistance in the regions would include "continued support for Cambodia, Laos and Vietnam," "support for self-reliant development in Central Asia and the stabilization of Afghanistan," and the "stabilization of Georgia, Ukraine, Azerbaijan and Moldova," according to Aso.

As Aso says, Japan should deliver the "universal values" such as democracy, freedom, human rights, rule of law and a market economy to less democratic and free areas. I am for that; But this seems to be a photocopy of what the U.S. president George W. Bush pursues as a primary goal of his foreign policies. Japan should have its own original values in a foreign policy vision, for example, "Bushido" spirit, which tells us to be gentle to the poor and the weaker. * Bushido: The traditional code of the Japanese samurai, stressing honor, self-discipline, bravery, and simple living.

And he also suggests that Japan be actively involved in establishing the arc of freedom and prosperity. This is also an imitation of Bush's diplomacy. How will he persuade the countries disturbing the freedom and human rights of people like China, Russia and North Korea to promote such universal values in their countries?

I think that what he says is right. However, he should unveil rather "how" he will do next to help promote democracy and freedom in the Eurasian continent.

Tuesday, November 28, 2006

Let Me Know!

If you know that, please let me know. Of course, please introduce your original blog, too. Thank you.

Sunday, November 26, 2006

Colon And Semicolon: The Usages

As I have said again and again, I'm not a non-native speaker of English. I often don't know how I should compile what I want to say in English. Especially, I wonder how I should use a colon and a semicolon properly, writing an essay. Distinguish them clearly is very important and necessary to write English and to make myself understood correctly.

A colon means:

a punctuation mark ( : ) used after a word introducing a quotation, an explanation, an example, or a series and often after the salutation of a business letter.

I will show an example: She has been to numerous countries: England, France, Spain, to name but a few. The colon used in the above sentence corresponds to the English words, “namely” and “such as”.

A semicolon says:

a mark of punctuation ( ; ) used to connect independent clauses and indicating a closer relationship between the clauses than a period does. For instance, it was six o'clock in the afternoon; the sun was low in the west. Of course, the above sentence can be expressed by two independent ones. If I want to indicate a closer linkage between the two, I use a semicolon to connect them.

I may have made following grammatical mistakes: It is only one year since he began to study French, however, he has already made remarkable progress. You found mistakes? In this case, I have to put a semicolon in front of however like that: …study French; however, he has...

See this site for details. To sum up, a colon introduces an example whereas a semicolon a close relation.

To this blog’s viewers:

If you have any other comments related to the usages of colon and semicolon, please let me know about that.

Saturday, November 25, 2006

Tax For Regional Recovery

Finance Minister Omi is thinking about planning to shift road taxes to general revenues and expending them on reviving regional communities. I think it is a good plan. I hope he will realize the plan. Here's the excerpt:

Saturday, Nov. 25, 2006

Omi eyes tapping road taxes to rev up regional economies

Kyodo News

The government may allocate tax revenues marked for road projects to revitalize regional economies as part of a plan to shift the money to general revenues, Finance Minister Koji Omi said Friday.

In reiterating the government plan to shift revenues from road-related taxes to general revenues, Omi told reporters, "Since there is also a need to revitalize the regional economies, we will address the matter." The Cabinet's priority is to revitalize the regional economies, ....as pledged by Prime Minister Shinzo Abe.

The Fiscal System Council, a body that advises the finance minister, also recommended Wednesday that funds from various road-related taxes, including the gasoline tax and the automobile acquisition tax, be used to cover general expenses.

The rates of the road-linked taxes, which include state and local levies, have been roughly doubled since 1974 in order to carry out road projects across Japan.

Some ruling party lawmakers strongly oppose the plan, saying tax rates should be returned to previous levels if the revenues are used for projects other than road-related ones.

However, why do some politicians oppose such an epoch-making plan? Here's my conjecture: It is because they benefit from the road-related services. They protect their special interests because they want to keep the votes of the people who engage in the road-related services like constructors and staffs employed by road agencies. In economic words, this is a kind of rent-seeking.

I don't blame such politicians for seeking not national interests but their own special interests. I expect most of them will not be supported because many people come to realize that they do the political activities for not national interests but themselves. This may be a sort of the effects of Koizumi structural reforms.

Thursday, November 23, 2006

More Lawyers Are Bad For Lawyers Themselves, But Good For Consumers

What's the effect of the increase in lawyer? To answer this question, we need some basic principles of economics. Today's topic is about the impact of an increase in lawyer on our society and life. I'll tell you about some of the effects from the perspective of elementary economics ― a supply-demand diagram.

An increase in lawyer, translated into economics idea, means the rightward shift of the supply curve of lawyer. The demand for lawyer unchanged, the number of lawyer increases and the price of lawyer decreases. What's the meaning of a decrease in the price of lawyer? For example, it is thought to be a legal consultation fee. In Japan, consulting with lawyer costs about US$40 per half hour. I don't know whether it is expensive. An increase in lawyer would push down the fee and thus pay him or her less. (Of course, consulting with very popular and competent lawyer would cost higher than with normal one, because the demand for very popular one is higher.)

Lower payment for lawyer leads to high benefit for the customer, however. Lower price of lawyer may increase the demand for lawyer. This problem has something to do with what sort of goods lawyer offers: The demand is less likely to be sensitive to the downward change of price because not all the services offered by lawyer are luxury goods. And so, in an economics term, the elasticity of the demand to the price change would be relatively smaller. (Employing a very famous and talented lawyer may be no better than using luxury goods. And then the elasticity may be larger.) What does a small elasticity imply? A smaller elasticity of demand indicates that the demand curve slopes steeper. If the supply of lawyer increases(the supply curve shifts rightward), the price of lawyer's services would decrease even more because of a steeper slope of the demand curve. This is a worse thing to lawyer.

From the viewpoint of "welfare economics", on the condition that the market is highly competitive, the surplus of lawyer (a producer surplus) gets smaller and the surplus of the costomer (a consumer surplus) larger if the supply shifts to the right. In other words, lawyer earns less and becomes unhappier and, at the same time, the costomer benefits more and happier. It is easier for consumer to take the legal services offered by lawyer when he or she faces the problems of domestic violence, divorce, company set-up and so on. At last, the total surplus (a social welfare; something like an index of happiness of all the members in a society)increases and thus the market outcome is socially efficient. That is, everyone in our society gets much better and happier than usual, at least except the lawyer.

To my analysis, an increase in lawyer is a very good thing to everyone in our society, of course, including me and except lawyer. I approve of increasing lawyers because I am not a lawyer.

Monday, November 13, 2006

Washington's Concern For the Asian Union

See the relevant excerpt:

Taku Iwaki / Yomiuri Shimbun Staff Writer

Yomiuri Shimbun, Nov. 9, 2006

..... The United States reportedly wants to give a boost to the idea by having the APEC members agree to enter into a joint study on an FTAAP, looking into hurdles that will have to be surmounted for the realization of an all-inclusive free trade agreement as well as the merits of such an accord for about one year.

.....In East Asia, China has been strengthening its economic influence by concluding free trade agreements with ASEAN.

Japan, for its part, also has proposed its own initiatives for concluding an East Asian Economic Partnership Agreement and setting up an East Asian version of the Organization for Economic Cooperation and Development. Multilateral talks on the initiatives have begun, involving 16 countries--the 10 ASEAN member states, Japan, China and South Korea as well as Australia, India and New Zealand. The APEC region and East Asia have the world's leading high-growth emerging economies such as China, India and Russia.

From the U.S. perspective, it is the most realistic to make the best use of APEC to keep itself part of Asian economic integration. A Japanese government source said Washington is apparently trying to use APEC as leverage to open up the Asian market. .....However, China, which has been increasing its economic sway over ASEAN, has been reacting strongly against U.S. involvement. In 2004, China proposed an East Asia Free Trade Area plan, including ASEAN, Japan, China and South Korea. Against this backdrop, Beijing been insisting that trade liberalization in the ASEAN plus Three zone--which includes Japan, China and South Korea--should precede the conclusion of an APEC-wide free trade accord.

According to the above article, the APEC region and East Asia have the world's leading emerging economies such as China, India and Russia.

To sum up, the aims of the U.S. are thought to be:

(1) The U.S. wants to make the best use of APEC to keep itself part of Asian economic integration.

(2) The U.S. wants to try to use APEC as leverage to open up the Asian high-growth emerging market.

The U.S. economy will go into stagnation in the long run because of the increase in the aging people in the U.S., as well as in many other developed countries like Japan. Although the number of incoming foreign people is now ingreasing in the U.S., it is uncertain for them to be the main engine of this country's economic growth. In theory, increasing population would lead to high economic growth. However it is only in the short run. In the long run, as the Solow-Swan model says, an increase in people does not lead to persistent high growth but technological progress does. It is uncertain whether they contribute to the advance of production technology and the accumulation of high-tech knowledge in the U.S.

If most immigrants are from low-income countries like Mexico and other South American countries, they would be less educated and less skilled, and thus it would cost very much for the U.S. local or federal government to provide them with fundamental educations, medical care, unemployment insurance and any other social services. They are generally thought to earn so less that they can't pay taxes. Therefore the presence of them may be the big fiscal burden to the U.S. economy.

From this perspective, the Washington's aim is obvious: the U.S. joins the growing Asia market to enhance its export to it. It sells more goods and services to the region and increases the demand for the products by the U.S. and internal employment. By doing so, the U.S. can keep its economic growth so sustainable as to finance the "civil minimum" of the social security for low-income immigrans and elder people.

So far the U.S. economy has been so large that it has been less related to the rest of the world. However Washington begins to feel seriously the necessity of joining the booming market in the world, facing its expected economic stagnation. Washington's concern for the international integration in the East Asia region stands for the awareness that "we can't live alone in a globalized world any longer" . In this regard, the U.S. is not the super-largest country any more in the world. This case shows that Washington comes to realize it.

Sunday, October 29, 2006

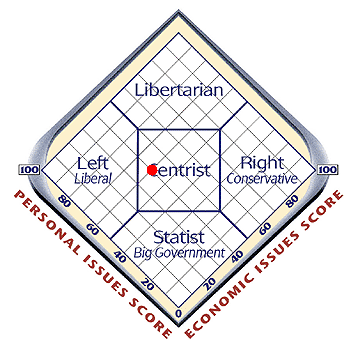

My Politics

I am a centrist in terms of political position: CENTRISTS espouse a "middle ground" regarding government control of the economy and personal behavior. Depending on the issue, they sometimes favor government intervention

and sometimes support individual freedom of choice. Centrists pride themselves on keeping an open mind, tend to oppose "political extremes," and emphasize what they describe as "practical" solutions to problems. See this interesting site!

Thanks a lot for the pointer, Greg Mankiw's blog.

Sunday, October 22, 2006

Score of 5

Sunday, October 15, 2006

A December Hike in Rate?

My answer to such a question is as follows: Tomorrow never knows. However it is more likely that BOJ will raise the interest rate before the end of the year. Here's the relevant excerpt:

Half of economists see BOJ's next rate hike by January: survey

Jiji Press, October 13, 2006

Half of the private-sector economists polled by a government affiliate expect the Bank of Japan to carry out another interest rate increase by January next year, according to the survey results released Thursday. The Economic Planning Association, affiliated with the Cabinet Office, surveyed 34 economists at private-sector financial institutions. Of them, 17 predicted the next rate hike by the central bank would come by January.

The BOJ raised its unsecured overnight call rate target in July to around 0.25 percent from almost zero percent, its first credit-tightening step since August 2000.

Of those surveyed, nine foresee the BOJ's next move coming in December this year, while five each predict the rate hike taking place in January and February next year. The earliest forecast was for November this year, backed by three of the economists.

Another excerpt:

Central bank won't decide monetary policy on consumer prices alone

Mainichi Shimbun, October 5, 2006

The Bank of Japan won't set monetary policy based on consumer prices alone, a senior bank official said Thursday."Consumer prices are important data, but we will not determine monetary policy on that alone," said Bank of Japan Deputy Governor Toshiro Muto.

"We are closely watching developments of the economy and other movements," told reporters in Kyoto, after meeting regional business leaders there. Muto also said he does not have any preconceptions about when to raise the benchmark interest rate, now at 0.25 percent.

....With prices inching up after years of deflation, analysts have been speculating about when the Bank of Japan will next raise rates. Japan's core consumer price index, which excludes volatile fresh food prices, rose 0.3 percent in August, the third monthly gain under a new, revised calculation method. Under the old system, it would have been the 10th consecutive monthly increase.

Actually Toshihiko Fukui, Governer of BOJ, told the press that BOJ would not keep the rates at the present level. Mr. Fukui didn't deny that BOJ would raise the rate. This Fukui's statement will have some influence on the people's expectation and thus the next development of the Japanese economy: Not denying a hike in the rate seems to be no better than a would-be hike. That is, it makes many people think that BOJ wants to raise the interest rate some day in the future. And the economy is likely to be shrinked by Fukui's prediction.

In fact, of those surveyed, nine economists foresee the BOJ's next move coming in December. Their conjecture will also make the people think of the next hike in the rate and thus the economy will be influenced by itself. I think Mr. Fukui knows that his policy change affects not only the economy itself but also the people's expectation on the next situation of the economy. From this viewpoint, Mr.Fukui seems to aim for a next hike in the rate. He is sure to want to raise it within the year. In any case, there will be a hike in the future.

Saturday, October 14, 2006

10,000¥ for Good Habit

The hair of the Japanese students is generally black, which is different from that of many of the Western. And there is some resistance against students' dyeing hair brown and golden in the Japannese society. A traditional student rule in the Japanese school bans dyeing hair brown and golden and wearing pierced earings. I think it to be one of the original culures of Japanese tradition. Having black hair and not wearing pierced earings at school is thought to be a good manner and habit for students in Japan.

Surprisingly, the University made a proposal to give 10,000¥to the students who have stopped dyeing hair brown and golden and wearing pierced earings in order to have the students take a social responsibility for their behavior and habit and to have a sence of social manner.

However there are strong oppositions to such a proposal from both internal and external various kinds of people like students, teachers, journalists, pundits and so on. Some oppositions say that the earnest students can't have no reward for not dyeing hair brown and not wearing pierced earings, while the insincere students who dye hair brown and wear pierced earings can be rewarded 10,000¥.

It is natural to oppose such a ridiculous proposal, I think. The university eventually made a decision not to reward the students who have stopped dyeing hair brown and wearing pierced earings. A good choice. I think that the University needs to talk the students into not dyeing hair brown and not wearing pierced earings. However this case will create quite a stir in the educational circles.

Tuesday, October 10, 2006

2006 Nobel Prize of Economics

Here's the excerpt of the Columbia News:

Professor Edmund S. Phelps Wins 2006 Nobel Prize in Economics

Edmund S. Phelps, McVickar Professor of Political Economy at Columbia University and director, Center on Capitalism and Society at the Earth Institute, was awarded the Nobel Prize in Economics on Monday, October 9 by the Royal Swedish Academy of Sciences.

Phelps won the award – officially named the Sviriges Riksbank Prize in Economic Sciences – for his analysis of intertemporal tradeoffs in macroeconomic policy.

.....Low unemployment and low inflation are central goals of stabilization policy. During the 1950s and 1960s the view of a stable tradeoff between inflation and unemployment was established, the so-called Phillips curve. According to this, the price for reduced unemployment was a one-time increase of the inflation rate. Phelps challenged this view through a more fundamental analysis of the determination of wages and prices, taking into account problems of information in the economy. Individual agents have incomplete knowledge about the actions of others and must base their decisions on expectations. Phelps formulated the hypothesis of the expectations-augmented Phillips curve, according to which inflation depends on both unemployment and inflation expectations.

As a consequence, the long-run rate of unemployment is not affected by inflation but only determined by the functioning of the labor market. It follows that stabilization policy can only dampen short-term fluctuations in unemployment.

Hearing the news, I want to know more about Phelps' research and the relevant studies on the intertemporal tradeoffs. Recently I have read one article about the tradeoffs. I think it a good reference.

Sunday, October 08, 2006

Booming Japan

The Yomiuri Shimbun

Oct. 7, 2006

The current economic expansion phase will most likely equal that of the Izanagi boom, which was the longest continuous period of growth, lasting four years and nine months in the late 1960s.

The milestone comes as the government decided Friday to declare in its monthly economic report for October that the economy is still in the recovery phase, government sources said.

The report will be announced Thursday. The current economic expansion phase started in February 2002.

The Izanagi boom occurred in the middle of the nation's high economic growth period and lasted from November 1965 to July 1970.

In its outlook in the monthly economic report, the government will say the economic recovery supported by the domestic private-sector demand is expected to continue for a while, the sources added.

I feel it somewhat strange to hear the economy recover. Has the deflation faded away yet? I don't think so.

Tuesday, October 03, 2006

For Good Relations with China and ROK

Japan gets chance to improve Asian relations as Tokyo and Seoul, Beijing agree to talks

Mainichi Shinbun

Oct. 2, 2006

Abe has made improving Tokyo's relations with Beijing and Seoul the core of his diplomatic policies. Chinese and South Korean leaders hope that Abe will play a leading role in taking concrete action in clarifying the Japanese government's view on its history of wartime atrocities in Asia, according to the sources.

However, the Chinese and South Korean governments are sticking to their demand that Abe refrain from visiting the shrine, where Class-A war criminals are enshrined among the war dead. If summit talks between Japan and China and Japan and South Korea highlight the wide gap on the Yasukuni issue and views on Japan's wartime aggressions, it could make it more difficult to improve their strained relations, observers fear.

...."China-Japan relations are at an important historical phase," Premier Wen Jiabao said, with another top official repeatedly calling for leaders to "work together" to improve bilateral relations. Observers say Tokyo may have already promised that Abe will at least make a statement on the issue during the upcoming summit meeting that will satisfy Beijing. .....As Japan and China move toward improving ties, South Korea also appears to have made a realistic decision when it also agreed to hold summit talks between Abe and President Roh Moo-hyun, the diplomatic sources said.

However, it remains to be seen whether the upcoming Japan-South Korea summit talks will be a turning point in bilateral ties. "Even if the Abe administration is inaugurated, our stance toward the Yasukuni issue will remain unchanged," a high-ranking official of the South Korean government said. Seoul has also urged Japan to take "sincere action" to clarify its interpretation of history, specifically the brutal acts committed during the Japanese occupation of the Korean Peninsula during World War II.

Anyway, Abe should not visit Yasukuni shrine, which will solve the problems between China, ROK and Japan in the end. However I don't think so. The difficulties could not be overcome as long as China and ROK play the role of the heroine of tragedy. As far as Abe doesn't insist on his ideas about the visit to Yasukuni and his interpretation of the Japanese aggression history, Japan could not have China and ROK understand well what it will do for improving the relations with China and ROK.

What This Recovery Tells

The DI figure is calculated by subtracting the percentage of companies reporting unfavorable business conditions from that of those reporting favorable conditions. BOJ announces the Tankan survey every three months. The latest survey was conducted from Aug. 30 to Sept. 29, covering 9,863 firms.

Here's the excerpt:

The Yomiuri Shimbun

Oct. 3, 2006

The first survey since the central bank ended its five-year zero-interest policy in July confirmed the steady overall economic improvement was sustained even with the interest rate above zero. Analysts said the figures were above market expectations, and that the result might encourage the central bank to go forward with another interest rate increase in coming months.

The improvement in business sentiment was especially notable in raw material-related industries and exporters that benefitted from declining oil prices and a weaker yen. The survey also showed a rise in corporate manager sentiments that there are human resource shortages.

.....As for capital investment in plants and equipment, major manufacturers in all industries planned to spend an average of 11.5 percent more in fiscal 2006 than the previous year. The figure was at the highest level since fiscal 1990's September survey, near the height of the nation's bubble economy.

The employment index, which is calculated by subtracting the percentage of companies reporting underemployment from that of those reporting overemployment, was three points down from the previous survey at minus eight for all industries of all sizes, meaning that more companies are becoming shorthanded. This feeling of employment shortage was the greatest since August 1992.

The biggest contributor to the improvement in major manufacturers' business sentiment was the strong performance of raw material industries. The slowdown in crude oil prices helped raw material firms such as steel and nonferrous metal makers turn profits, while also succeeding in passing on earlier high oil costs in sales prices. The DI figure for steel manufacturers rose 14 points to plus 53, and rose 13 points to plus 41 for nonferrous metal makers.

Though small and midsize companies lag big firms in business sentiment, their projection for capital investment reflected growing optimism among corporate managers.

The concern now is the deceleration of the U.S. economy. Japan's exporters may lose momentum if demands abroad continue to slow down. Some analysts even think the nation's economy has already peaked, and are alarmed another interest rate increase could severely hurt the financing of small and midsize companies.

According to the above excerpt, there are mainly three characteristics of the recent recovery of the Japanese economy:

(1) The improvement in raw material-related industries and exporters

The slowdown in crude oil prices enabled raw material firms such as steel and nonferrous metal makers to turn profits, while also passing on earlier high oil costs in sales prices. Declining oil prices, a weaker yen and booming China and US boost up the exporters.

(2) The employment shortage for all industries of all sizes

More companies are feeling shorthanded. It seems that the Japanese economy is picking up. This is, however, rather the sign that Japanese economy is becoming aged: The number of retiree is sure to increase, while decreasing younger workers. So many companies need hiring workers so as not to face the shortage of human resource.

(3) Weaker sentiment in small and midsize companies

This recovery might be merely big firms'. Many small and midsize companies might not be benefitting from this recovery. Most of all companies in Japan are small and midsize ones, which is, in terms of the number of firms, about 70 percent of all firms. In this regard, the increasing profit from the recovery is unlikely to be distributed fairly among most companies and workers. It can say that it is far from the true recovery that improves the life of every member of our economy.

Saturday, September 30, 2006

What Mr. Abe Wants to Do

Here's the excerpt:

The Yomiuri Shimbun

Sep. 30, 2006

....As reasons for his decision to review the right to collective self-defense, which the country currently has but cannot exercise under the government's interpretation of the Constitution, Abe pointed out changes in the international situation, such as the fight against terrorism and the world's expectation that Japan will make an international contribution. He said the government would study the matter "to make the Japan-U.S. alliance function more efficiently, so peace can be maintained." As the country's first prime minister born after World War II, Abe stressed his resolve to build a new nation and his hopes of passing at an early date a national referendum bill defining the procedures for constitutional amendment. "The present Constitution was established 60 years ago, when Japan was under occupation," Abe said. *

.....He also said he would improve soured relations with China and South Korea, saying the two countries are important neighbors, calling on all sides making efforts to have forward-looking, frank dialogues.

In addition to seeking a revision to the Fundamental Law of Education, Abe said he would establish a new council in the Cabinet to promote measures to overhaul the nation's education system, such as a requirement for teachers to renew their teaching licenses periodically to ensure standards are maintained, and evaluations of schools by third parties.

....On his policy to deal with the issue of Japanese nationals abducted by North Korean agents, over which Abe's tough attitude drew national acclaim, the new prime minister hinted he would continue to press North Korea.

"Without a resolution of the abduction issue, there will be no normalization of diplomatic ties with North Korea," Abe said. He added he would demand Pyongyang return all the abductees home alive and would head a task force to tackle the abduction issue.

*Bold letters by the author of this blog

(1) Amending the Constitution

To excersize the right to collective self-defense and to maintain peace, Mr. Abe wants to revise the Constitution. As he says (pointed by bold letters), "the present Constitution was established when Japan was occupied by the Allies." While some pundits critisize it as the "MacArthur's Constitution", others disagree to the constitutional amendment. According to the cons, Mr. Abe wants to enable Japan to arm itself and to invade other countries. I think it's a ridiculous conjecture.

You may not know that arming itself is prohibited under the present Constitution. Thus now Japan cannot have the Self-Defence Forces. And it also cannot invade or attack other countries! Mr. Abe, in my conjecture, wants the existence of the Self-Defence Forces not to be interpreted currently by the government but to be admitted by amending the Constitution. And then he wants to put an end to the fruitless discussion on whether it is against the Constitution.

(2) Improving the relations with China and South Korea

He would like to improve the relations with China and South Korea to resolve the issue of the abduction by North Korean agents. He wants to continue to press North Korea to return all the abductees home alive.

(3) Revising the Fundamental Law of Education

To raise up talented people and thus to promote the innovation, he wants to change the nation's education system. This is the most eye-striking in his proposing policy. I don't know what he really wants to do by revising the Fundamental Law of Education and the detail on this issue, however.

Thursday, September 28, 2006

Japan's strength

Trade surplus, however, doesn't prove to be the advantage competitiveness, but a large amount of saving held by the domestic people or short for domestic investment for equipment. It shows merely the stagnant economy in the 1990s. What is the Japan's strength? Here is the excerpt of good article:

Yomiuri Shinbun

YIES / 'Japan's strength lies in keeping jobs at home'

Koya Ozeki / Daily Yomiuri Staff Writer

Sep. 26, 2006

Japanese firms may have better odds of beating out their U.S. rivals in the global market in coming years, thanks to their reluctance to ship jobs overseas, Prof. Suzanne Berger of Massachusetts Institute of Technology said during a lecture in Tokyo.

"Mistakes that companies make is that somehow cheap labor can be a solution that will save them, and I think in the long run, cheap labor is really not a winning solution," she said at a Yomiuri International Economic Society (YIES) lecture Monday.

Berger led a study on 500 companies worldwide over the past five years, in search of a model for success in today's global economy. She recently put her findings into a book, titled "How We Compete."

.....Sony Corp. manufactures half of its top-of-the-line computers in Nagano Prefecture, whereas Dell Inc. made none of its computer components in the United States, according to her study. By keeping skilled labor in their homeland, Japanese companies retained a "capability that they could use in recreating themselves," she said. She also pointed out that although many companies in Japan and the United States have shifted manufacturing operations to China, the Japanese firms tended to build their own plants in China, whereas U.S. firms used outside contractors.

"My concern is that in dealing with contract manufacturers for our production in China, [U.S. firms] are failing to take advantage of the opportunity to learn about the China market," Berger said. But she believes Japanese firms are in a much better position to learn about the preferences of Chinese consumers. "Learning about a new market is a source of innovation," she said, and by missing that opportunity, "[U.S. firms] are failing to develop the capability for future sources of innovations."

Here I summarize Prof. Suzanne Berger 's remarks. Her points at discussion are put into three:

(1) By keeping skilled labor in their homeland, Japanese companies retained a "capability that they could use in recreating themselves."

(2) The Japanese firms tended to build their own plants in China, whereas U.S. firms used outside contractors.

(3) Learning about a new market is a source of innovation.

These are good lessons for not only businesspeople but also educators at school. The new prime minister, Abe, calls for the structural reform of Japanese education system. To many teachers and staffs at Japanese schools, Dr.Berger's points would be changed into:

(1) By keeping competent students in their homeland, the US universities retained a "capability that they could use in recreating themselves."

(2) The US universities tended to build their own campuses in itself, whereas Japanese universities used outside contractors like MIT, Princeton, Stanford, Yale, Columbia and Harvard.

(3) Learning about a new market is a source of innovation.

These might be good lessons for the people who are afraid of the future of Japanese universities. They should learn about a new market and thus lead to a source of innovation for rebuilding Japanese universities.

Wednesday, September 27, 2006

Stupid!! Mirror Man

Mainich shinbun

September 27, 2006

'Mirror Man' professor sacked over latest molestation allegations

NAGOYA -- The graduate school of Nagoya University of Commerce and Business has dismissed economics professor Kazuhide Uekusa after he was arrested for molesting a high school girl on a train, officials of the institution said Wednesday. Uekusa lectured on the national economic strategy as a visiting professor at the graduate school from April this year until July.

"We will make every effort to recover honor and trust in us," a spokesman from the university commented after announcing the dismissal of Uekusa, 45. Uekusa, from Tokyo, was arrested for molesting the girl earlier this month. In 2004, Uekusa was arrested for trying to look up the skirt of a high school girl at JR Shinagawa Station by using a hand mirror.

Another article reports:

Mainichi Shinbun

September 14, 2006

Famous economist Kazuhide Uekusa, now a visiting professor at a university, has been arrested for molesting a high school girl on a train, police said. Uekusa, 45, a visiting professor at the graduate school of Nagoya University of Commerce and Business, molested the 17-year-old girl on a Keihin Kyuko Line train. ......Uekusa's alleged actions came to light after the girl reportedly screamed, "Stop it." He was drunk at the time of the purported incident. "I don't remember what happened," Uekusa was quoted as saying.

Earlier in April 2004 when he was a graduate school professor at Waseda University, Uekusa was arrested for trying to look up the skirt of a high school girl at JR Shinagawa Station by using a hand mirror. He was indicted for the 2004 incident and fined 500,000 yen. He didn't appeal the ruling on the 2004 case, but has since insisted he was not guilty.

Monday, September 25, 2006

Mr. Abe on Tax Policy

The Yomiuri Shinbun

Sep. 24, 2006

Liberal Democratic Party President Shinzo Abe will likely propose 600 billion yen cuts in corporate taxes for fiscal 2007 to promote capital investment in information technology-related equipment, a source close to him said Saturday. As a concrete measure, the upper limit for depreciation of equipment, an amount which companies can deduct as losses from its profits when they purchase equipment or machines, will be raised from the current 95 percent to 100 percent of the purchase price. As the taxable profit will be compressed from now, the tax burden of companies will be reduced, said the source.

Abe is also considering expanding the so-called angel taxation system, a preferential treatment for individuals who invest in venture-capital corporations, the source explained. During his campaign for the LDP presidential election, Abe said that he would like to improve industrial productivity through technological innovation to aim at attaining real economic growth of around 3 percent. The envisaged corporate tax cuts will be one of the main pillars of his policy to back up technological innovation.

....According to a report compiled by the Economy, Trade and Industry Ministry in 2005, the amount of domestic investment in IT-related fields against gross domestic product is 2 percent, lower than 3 percent in the United States and 2.8 percent on a global average. In most major countries, including Britain and the United States, the upper limit for depreciation of equipment is 100 percent. Business leaders have long been asking the government to bridge the international divide.

Concerning the measure to assist venture capital, the scope of the angel taxation system will be expanded. Under the current system, individual investors can deduct an amount of investment made in venture-capital organizations from profits obtained through stock investments. The amount of investment into venture firms will also be deducted from interest on savings and other income from financial products, according to Abe's plan.

OK, Mr. Abe wants to stimulate the aggregate demand of the economy: A cut in corporate tax promotes capital investment and so does the demand for the related equipments. The equipment maker also promotes investment to enlarge its business. This "multiple effect" at last increases the effective demand of the economy as a whole.

Expanding a preferential treatment for investor in venture-capital corporations is also likely to boost the economy. New business generally stimulates the purchase for the goods and services. I think Mr. Abe is right. In Japan the economy is still stagnant because of insufficient demand for the goods and services sold in the market, although current news are reporting its recover.

I hope for the sound effect of Abe's tax cut and the promotion of new business.

Sunday, September 24, 2006

Is Inequality a Bad Thing? (3)

The Economist Jun 15th 2006

The rising sun leaves some Japanese in the shade

.....Arch-conservatives and left-wingers alike blame the income gap not just on globalisation clobbering the unskilled, but on the structural reforms and deregulation championed by the prime minister, Junichiro Koizumi, and his Liberal Democratic Party (LDP).

.....With the income gap a big topic in the race to succeed Mr Koizumi as prime minister this September, it is worth taking a closer look. Statistical problems always guarantee that the income gap, in any country, is contested ground. Even so, no matter which data are used, the trend looks the same: income inequality in Japan has risen since the early 1980s.

....Toshiaki Tachibanaki, an economics professor at Kyoto University, puts Japan behind only the United States, Britain and Italy in income inequality among the big rich economies. It once boasted Scandinavian levels of equality.*

Yet a closer look at the reasons behind the rise in inequality reassures somewhat. Fumio Ohtake, at Osaka University, notes that income distribution by age of household head has remained constant.* ....Older people tend to have the widest income disparity, since while some people retire to live on modest pensions, more senior managers get hefty pay rises in the last years of their working life, with pensions afterwards to match. An ageing population therefore scores higher on overall measures of inequality.*

....[The income gap] has grown among those under 30, according to a 2004 survey. This is probably due to an increase in the number of unemployed and those in part-time work. Between 1990 and 2005, the number of “non-regular” workers—ie, those on lower pay with neither full-time contracts nor benefits—rose from less than one-fifth to nearly one-third of the workforce, hitting the young (and working women) disproportionately. Labour flexibility did much to help Japanese companies escape from piles of debt over the past decade, and partly as a consequence they are now making record profits.

Take the taxi industry, for example, which has been opened up. Critics say there has been a fall in pay among drivers since deregulation, yet Mr Ohtake points out that the number of drivers has leapt, thereby reducing inequality. The rise in “non-regular” workers in Japan may in fact have narrowed the income gap, because the alternative was probably unemployment. But people do not see it that way.

*Bold letters by the author.

There are three points at issue:

(1) Is the income gap due to the structural reforms and deregulation led by Mr.Koizumi and his LDP?

It is very difficult to prove such a thing. Some economists say that the income inequality in Japan has risen since the early 1980s. If so, Mr. Koizumi and his policy is far less likely the culprit. Moreover others say that the income distribution by age of household head has remained constant. As Mr. Otake says, the increasing number of older people may have widen income disparity. According to that, widening income gap is a matter of course.

(2) Is the gap due to an increase in the number of unemployed and those in part-time work?

Between 1990 and 2005, the number of non-regular workers rose from less than one-fifth to nearly one-third of the workforce. This is more likely the culprit. In fact the wage gap between regular and non-regular workers is widening and causes to the educational gap between their children. This may be led by Mr. Koizumi's deregulation ― for example, opening up taxi industry has been the cause of a fall in pay among drivers. On the other hand, the increasing number of temps is said to lead to a fall in the unemployment. Which is higher, the benefit from a fall in jobless or the cost of the wage gap? I don't know that.

(3) Is the gap due to globalization?

In the world, this is more controversial issue than the above other 2 points. The income gap becomes larger due to the fierce competition between the national workers and the foreign workers. The national workers in developed countries like the U.S. and Japan are generally paid more than the developing countries' workers such as the Chinese and Brazilian. The manufacture factories are now being transformed to the developing countries and so are the jobs. As a result, some of national workers in developed countries are unemployed. It is, so-called, the problem of offshore outsourcing. This is, as a Harvard economist Gregory Mankiw remarks, a new type of international trade, which benefits many national people as well as many foreign people in developing countries. It is, however, very hard to say that the offshore outsourcing is the culprit of the income gap.

Communist Party against Mr.Abe

Japan Press Weekly

September 2, 2006

Abe made public his election platform that gives priority to enacting a new constitution as well as a "drastic educational reform." At a press conference in Hiroshima City, he expressed his intention to take the leadership in having the Diet initiate the revision of the Constitution. By stating, "I want to first work to get the national referendum bill enacted," he showed his strong determination to enact in the next Diet session the bill that will establish a procedure for the revision of the Constitution.

Asked by reporters, Japanese Communist Party Secretariat Head Ichida Tadayoshi on the same day said, "Abe's remarks and his book show his imprudence and precariousness."* Abe characterizes the preamble to the Constitution as a "written apology to the Allies in WWII," and asserts that Japan needs to abandon the "masochistic view of history."

Referring to these remarks, Ichida said, "It is very dangerous to make such remarks and deny that the war Japan waged was a war of aggression."*

Ichida pointed out that .....the next government will inevitably further promote the mal-administration of the Koizumi Cabinet, because (Mr. Abe) insist on maintaining the structural reform policy that has increased the social gap as well as adversely revising the Constitution and the Fundamental Law of Education.

With regard to the Yasukuni Shrine question, pointing out that (Mr. Abe) asserts that the prime minister must refrain from visiting the shrine based on a reflection over the past war of aggression and colonial rule, Ichida said, "(Mr. Abe )cannot advance diplomacy for peace and friendship in Asia."*

*Bold letters by the author

I summarized Mr. Ichida's remarks: Abe's remarks and his book show his imprudence and precariousness. It is very dangerous to make such remarks and deny that the war Japan waged was a war of aggression. He cannot advance diplomacy for peace and friendship in Asia.

He said no more than that he is against Mr. Abe. No policy proposal is made by Mr. Ichida. I think Mr.Ichida and the Communist Party should show us more rigorous policy visions and proposals to obtain a wide support from many people. I have heard nothing but they say the LDP breaks the society of Japan.

Mr. Abe's Assignments

Mainly there is put into three points:

(1) Diplomatic Policy

Now Japan can't do without the interdependences with the East-Asia countries like China and South Korea. So Japan should build a close friendship with them as well as strengthen the Japan-U.S. alliance for the sake of the security of Asia and Pacific region.

To promote the prosperity of the Asia and Pacific region and build a safer and stable community in the Asia and Pacific region, we must face the nuclear and kidnapping concerns and tensions on the Korean Peninsula and must persuade the Chinese and South Korean leaders to cooperate with each other toward the strategic regional security.

(2) Economic Policy

The Japanese economy is recovering from the persistent decade-long recession. Mr. Abe has the prime mission to promote the economic growth. He also gives priority to reducing government spendings and staffs. In the point of keeping the government's budget sustainable, he makes a right remark. However, he needs to propose raising the consumption tax rate at a time in the future for the sound pension system and social security. Raising consumption tax rate is likely to decrease the aggregate demand and make the economy gloomy. He faces a difficult policy choice between tax hike and growth promotion.

(3) Social Security Policy

Mr. Abe fails to convey a strong message on how to rectify the gap between the rich and the poor. I don't think that the social gap is the problem. However, it is likely the symptom of the problem. I think that he should keep in mind the free market economy and relatively reasonable government to conduct any policies. A free market economy benefits many people but on the other hand causes the economic gap and thus the conflict. Mr. Abe needs to remedy any tensions led by the cut-throat competition in order it can't impede the works of market mechanism and the economic gain caused by hard work.

To do that, he should revise the pension system and build firmer social security system for elder people. He suggests that the poor and the unhappy be provided with many opportunities to work for company and to brush up career skills. To create employment, he should also boost the demand of economy by cutting taxes and supplying money. It is, however, very hard to implement such a fiscal expansionary policy.

Monday, September 18, 2006

Game Theory in Action

Today I attended the lecture on game theory for the general public. Although this lecture was for beginners or elementary students, it was more hard to understand than had I thought. I wondered if every audience could understand what and how game theory describes our society and is applied to the real world. Some audience must have wondered how useful game theory would be in the real life. Also I did.

I once read an article on the use of game theory in the Harvard Business Review written by a consultant of McKinsey & Company. According to it, in the McKinsey & Company, they usually use game theory to build up the strategy for their clients to succeed in business. I doubted how they use game theory to suggest the plan of successful management to their clients.

In reality, to what degree is game theory useful? How can I change the world by knowing the cause and result of "Prisoner's Dilemma"? Certainly there are many scenes of Prisoner's Dilemma in our life: for example, price war between icecream shops, past nuclear competition between the US and the USSR, advertising lavishly new DVD products on TV between Sony and Panasonic and so on.

I like the idea of game theory but doubt the application of game theory for the firms' decision-making in the real world. To work for company, is game theory really useful to us?

Saturday, September 16, 2006

After Wind's Blowing:Returns

If you knew the whole outline of the tale:

After wind's blowing, sand flutters in the wind. →Many people have got some sand in their eye.→・・・・・→Basinsmiths get money.

you would be asked what we should have do when we had the leaky roof and answer it: Get rid of rats! Why? From this tale, rats ruin the roof and so we have the leaky roof. When a number of rats increases because many cats around the town were caught to skin in order to make the Japanese lute, the roof is more likely to be ruined and thus be leaky. When we have the leakly roof, too nany rats should be got rid of. This is the policy implication obtained from the tale.

Well, again, if you knew that tale but the different whole outline:

After wind's blowing, the roof is blown off.→We have the leaky roof.→We need the basins.→Basinsmiths get money.

you would be asked the same question and answer it: Strengthen the roof! From this story, a wind blows away the roof. We have to strengthen the roof not to be blown away. This is the policy implication from the above tale.

Which answer, on earth, is right? The answer depends on the cause of leaky roof, that is, whether it is because of rats or blowing wind. If many rats went around because of blowing wind, we might have the leaky roof even though we strengthened the roof. If the roof were blown off by wind, we would likely have the leaky roof even though we got rid of rats.

There is some reason why we have that saying at the macroeconomics class in Japan: If we took the cause of recession mistakenly, we would likely have the wrong prescription. The above saying is used well at class to have the econ students know the reason and the meaning of the hard time investigating the cause of recession. We can't solve the problem correctly if we misread it. Bring to light the problem and we can get the more correct solution to it.

Friday, September 15, 2006

After Wind's Blowing

(1) After wind's blowing, sand flutters in the wind.

(2)Many people have got some sand in their eye.

(3)Some people go blind.

(4)They play the Japanese lute to make a living.

(5)To make the Japanese lute, many cats are caught to skin them. (Japanese lute is made of the hide of cat. Those who protect animals may blame us Japanese for it.)

(6)Few cats are around there.

(7)Many rats go around and ruin the roof of house.

(8)The roof has a leak.

(9)Many basins are needed to take the falling drops of rain.

(10)Basinsmiths get money.

Do you like it? Some Japanese have the wrong tale of this saying: After wind's blowing, the roof is broken, basins are needed and thus basinsmiths get money.

This tale is used well for explaining and taking the case of the process of recession in the class of macroeconomics at college in Japan. (In fact I was taught this saying as a freshman at college.) This tale has a very similar flow chart to that of business cycle: Rising inflation, for example, leads to a recession.

(1)Economy is booming.

(2)Inflation rises.

(3)Ben Bernanke(the Chairman of FRB) contracts amount of money circulating the economy for fear of rising inflation.

(4)Interest rate rises.

(5) Spending for consumption is postponed and demand for investment diminishes.

(6)Aggregate demand(consumption & investment)falls.

(7)Inflation decreases.

(8)Economy goes to a recession.

This type of flow chart is somewhat similar to that of the above saying. Ben Bernanke keeps the above flow chart in mind when conducting monetary policy. And many economists also know that, even though they don't know that basinsmiths get money after wind's blowing.

Dr Mankiw, how about such a saying in your Eco10 class?